...

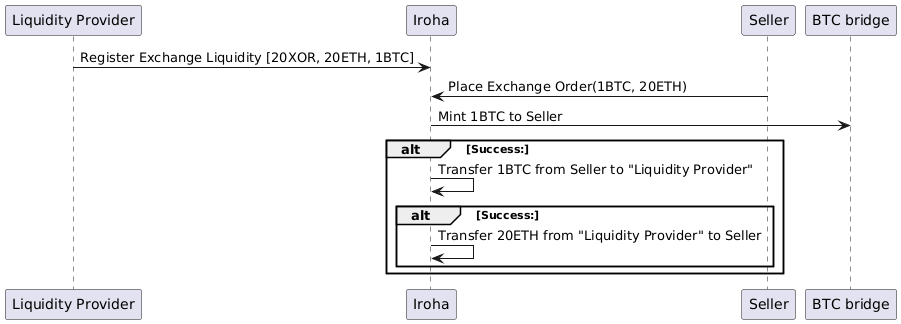

Liquidity Pools is another dimension in this set of scenarios for Decentralized Exchanges. Basically it can be used in pair with or without bridges, so let's take a more clean example without them. But let's not stick to an Exchange Pair and work with multi-currency liquidity:

Image Removed

Image Removed Image Added

Image Added

| Expand |

|---|

|

| No Format |

|---|

| @startuml

Trader"Liquidity Provider" -> Iroha: Register Exchange Liquidity [20XOR, 20ETH, 1BTC]

Seller -> Iroha: Place Exchange Order(1BTC, 20ETH)

Iroha -> "BTC bridge": Mint 1BTC to Seller

alt Success:

Iroha -> Iroha: Transfer 1BTC from Seller to "Liquidity TraderProvider"

alt Success:

Iroha -> Iroha: Transfer 20ETH from "Liquidity TraderProvider" to Seller

end

end

@enduml |

|

...

| No Format |

|---|

|

Feature: Decentralized Exchange

Scenario: Buyer exchanges 20xor for 100usd

Given Iroha Peer is up

And Iroha DEX module enabled

And Peer has Domain with name exchange

And Peer has Account with name buyer and domain exchange

And Peer has Account with name seller and domain exchange

And Peer has Asset Definition with name xor and domain exchange

And Peer has Asset Definition with name usd and domain exchange

And buyer Account in domain exchange has 100 amount of Asset with definition usd in domain exchange

And seller Account in domain exchange has 20 amount of Asset with definition xor in domain exchange

When buyer Account places Exchange Order 20xor for 100usd

And seller Account places Exchange Order 100usd for 20 xor

Then Iroha transfer 20 amount of Asset with definition xor in domain exchange from seller account in domain exchange to buyer account in domain exchange

And Iroha transfer 100 amount of Asset with definition usd in domain exchange from account buyer in domain exchange to seller account in domain exchange

Scenario: Buyer exchanges 1btc for 20eth across bridges

Given Iroha Peer is up

And Iroha Bridge module enabled

And Iroha DEX module enabled

And Peer has Domain with name exchange

And Peer has Account with name buyer and domain exchange

And Peer has Account with name seller and domain exchange

And Peer has Asset Definition with name btc and domain exchange

And Peer has Asset Definition with name eth and domain exchange

And Peer has Bridge with name btc and owner btc_owner

And Peer has Bridge with name eth and owner eth_owner

And eth Brdige has buyer Account in domain exchange registered

And btc Brdige has seller Account in domain exchange registered

When buyer Account places Exchange Order 20xor for 100usd

And seller Account places Exchange Order 100usd for 20 xor

Then Iroha mint 1 amount of Asset with definition btc in domain exchange to seller Account in domain exchange using btc Bridge

And Iroha mint 20 amount of Asset with definition eth in domain exchange to buyer Account in domain exchange using eth Bridge

And Iroha transfer 1 amount of Asset with definition btc in domain exchange from seller account in domain exchange to buyer account in domain exchange

And Iroha transfer 20 amount of Asset with definition eth in domain exchange from buyer account in domain exchange to seller account in domain exchange

Scenario: Buyer exchanges 20xor for 100usd

Given Iroha Peer is up

And Iroha DEX module enabled

And Peer has Domain with name exchange

And Peer has Account with name traderliquidity_provider and domain exchange

And Peer has Account with name seller and domain exchange

And Peer has Asset Definition with name xor and domain exchange

And Peer has Asset Definition with name btc and domain exchange

And Peer has Asset Definition with name eth and domain exchange

And traderliquidity_provider Account in domain exchange has 1 amount of Asset with definition btc in domain exchange

And traderliquidity_provider Account in domain exchange has 20 amount of Asset with definition eth in domain exchange

And traderliquidity_provider Account in domain exchange has 20 amount of Asset with definition xor in domain exchange

And seller Account in domain exchange has 20 amount of Asset with definition eth in domain exchange

When traderliquidity_provider Account registers Exchange Liquidity 20xor and 20eth and 1btc

And seller Account places Exchange Order 20eth for 1btc

Then Iroha transfer 1 amount of Asset with definition btc in domain exchange from seller account in domain exchange to traderliquidity_provider account in domain exchange

And Iroha transfer 20 amount of Asset with definition eth in domain exchange from traderliquidity_provider account in domain exchange to seller account in domain exchange |

...