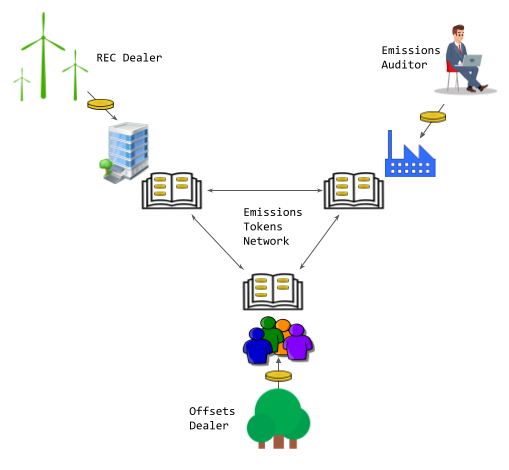

This is the emissions token network from the Operating System for Climate Action.

A Demo

| Widget Connector | ||

|---|---|---|

|

You can try it yourself at http://emissionstokens.opentaps.org/. You will need to a Goerli testnet wallet and some test eth (which you can get here.)

How it Works

The emissions tokens network uses tokens to represent the emissions of an entity, which could be an organization, a building, or even a person. It is the sum of all the emissions from different channels such as the utility emissions channel, plus offsetting Renewable Energy Certificates and carbon offsets. Each token represents either an emissions debt, which you incur through activities that emit greenhouse gases, or an emissions credit, which offset the debt by removing emissions from the atmosphere.

...

- Token authority – a network operator or a supranational/national/regional carbon authority (see below) which authorizes a number of issuers of tokens.

- Token issuers – auditors of carbon emissions or certifiers of renewable energy or carbon offsets. Auditors would issue tokens based on audits of companies' operations. Certifiers would issue tokens based on projects they've certified.

- Token consumers – businesses and individuals who buy REC's or offsets to offset their own emissions.

Token Types

- Audited emissions - represents the actual emissions of an organization, as reported by an auditor.

- Carbon offsets - represents reduction of emissions through projects such as forestry, sequestration, etc.

- Renewable Energy Certificates (REC's) - represents energy generated from renewable sources such as wind and solar

All 3 types of tokens are fungible. The audited emissions tokens are "retired" (see below) as soon as they're issued from an auditor to a company or consumer. The offsets and REC's could be traded but are eventually retired when used to count as emissions offsets.

Token Operations

- Add new token definition – Multiple types of emissions tokens can be supported on the network, such as emissions, Renewable Energy Certificates (REC's), and offsets.

- Register/Unregister issuer – In our case, it would be registering and unregistering auditors or project certifiers authorized to issue tokens.

- Register/Unregister consumer – Auditors and project certifiers would register their customers on the network.

- Issue – Issues tokens based on results of operations from audited companies and renewable/offsets projects. Note that each issuer would be able to only issue allowed types of tokens, so an emissions auditor can issue Audited Emissions, a carbon offset developer or certifier Carbon offset tokens, and renewables developer REC's.

- Transfer – Emissions audit tokens cannot be transferred: They are retired as soon as issued and stay with the organization that was audited as a record of their emissions. Offsets and REC's can be transferred until they are retired. The total amount that could be transferred from one account to another is the sum of the tokens in their account minus the amount that has been retired.

- Retire - this is not in eThaler but would need to be implemented. When a token is marked as "retired," it is counted towards the emissions reduction of the retiring organization and cannot be transferred again.

- Burn – this would not be implemented.

...

With these tokens, we can calculate the net emissions by first subtracting the effect of Renewable Energy Certificates (REC's.) REC's offset the energy produced by non-renewable sources, so we'll need to get the non-renewable vs renewable energy mix in the original emissions tokens/assets from utility emissions data channel. Then we subtract the offsets to get the net emissions.

Integration with Hyperledger Fabric

This network would be connected with Fabric channels such as the utility emissions channel through the auditors. The utility emissions channel is operated by an auditor on behalf of its customers. The auditor would also be on this network and would issue audited emissions tokens to its customers' wallets. The customers would then transact in emissions and offsets on this network using their wallets.

Possible Use Cases

Cap and Trade:

- The central bank could be the cap and trade authority.

- Tokens for allowable emissions could be issued to all members of the cap and trade regime.

- They can trade the tokens amongst themselves.

- As emissions are counted, during an audit, cap and trade tokens should be retired.

...

- The network operator is a neutral, blockchain technology vendor who runs the network for a (very very very small) fee.

- It could mint and issue tokens in response to requests from network members, who pay a fee for the tokens to be issued.

Outstanding Issues

Transfer of emissions down the supply chain and avoiding double counting are major issues to be addressed in the future. The problem is that emissions are counted in multiple ledgers, for example this document from Gold Standard describes how they could be counted in both offsets and national registries. See also the Gold Standard double counting guidelines document.

...