Versions Compared

Key

- This line was added.

- This line was removed.

- Formatting was changed.

Image Modified

Image Modified

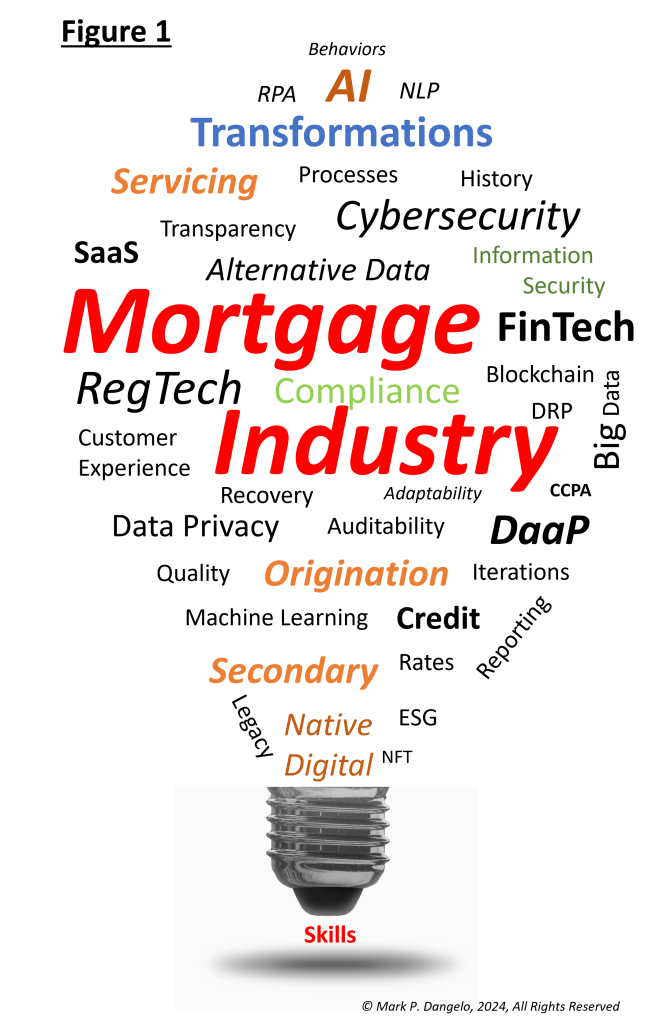

Welcome to the Mortgage Industry Subgroup

!Purpose

To foster sustainable, inclusive communities through efficient, fair, and quality mortgage lending around the globe.

Vision

To To securely close home loans as efficiently as an auto loan while delivering a superior digital customer experience.

Mission

To educate banks, mortgage lenders, vendor partners, investors, land record-holdersreal estate records custodians, and government agencies around the globe in the of production-ready blockchain technologies that support the global housing mission of creating sustainable, inclusive communities through efficient, fair, and quality mortgage lending.

Introduction

The Mortgage Industry Subgroup (MIS) is focused a global community who will focus on technical and business-level issues challenges within the Mortgage Industry and on developing applicable use cases for blockchain technology in the Mortgage Industry (MI). It The Subgroup will bring together business, technical, academic, and industry-related expertise to address challenges with the MI. These include trust and transparency challenges due to the involvement of multiple entities, work together on blockchain education, use case identification, POCs and production implementations.

At the heart of financial services is trust and, as an industry, we rely on our technology to record the truth of each transaction. The life cycle of a mortgage has a complex framework, involving many entities, for example originators, servicers, investors, regulators, and a vast ecosystem of vendors and service providers. This complexity creates trust issues and transparency challenges with no clear mechanism to track end-to-end activities of every entity, and complex operations due to the involvement of many partners, vendors, customers, distributors, and network providers. These aforementioned problems can be addressed through the application of blockchain technology.

1.1 Mission

. Each party must maintain their own independent database of customer information, loan transactions, and third party information. Data must be validated, re-validated and financial transactions need to be reconciled with third parties. Blockchain can address many issues in the lifecycle of a mortgage with its decentralized and distributed ledger technology, with trustless operability, that is immutable and auditable.

Objectives

- Promote blockchain education for the mortgage industry participants across business, technical to government agencies and vendor/service partners

- Identify specific opportunities where the application of blockchain technologies can meaningfully advance the state of the mortgage industry

- Provide a foundation for real-world use case identification, blockchain technology alignment, and operational validation of technology fit for purposeProvide recommendations for the ethical use and implications of blockchain technologies

- Promote the community education of, and participation in blockchain technologies, policies, and protocols

- Serve as an open channel of communication between the membership of this Special Interest Group and the leadership of Hyperledger to inform leadership on prospective improvements of Hyperledger frameworks and toolsets, within the context of the mortgage industry

1.2 Goal

The MI-SIG will use decentralized, permissioned HL blockchains to propose and build user-friendly apps that respond to the relative disorder of permissionless environments, where the interests of participants are hard to safeguard.

Following comparative analyses of the technical challenges (and hypothetical solutions) facing MI participants, these DLT apps/dapps will be created for lenders, title companies, capital market companies, and third-party providers regardless of location or size. This implies a focus upon UX/UI concerns over command-line tools, all in the name of access and inclusivity.

1.3 Sub-groupMortgage Industry (MI) Subgroup Contacts

| Role | Name | Contact |

|---|

| MI Subgroup Chair | Angel Alban | aalban@zventus.com |

| MI Subgroup Chair, Technology | Marvin Bantugan | mbantugan@zventus.com |

| Hyperledger Staff POC | Karen Ottoni |

| MI Subgroup, Mortgage Servicing | James Hendrick | jhendrick@zventus.com |

Discord Channel:

https://discord.com/invite/hyperledger

Join the Mortgage Industry Subgroup

Step 1

.4 News and Updates1.5 Meeting Schedule Notes & Recordings

You are Welcome

: Create your Linux Foundation ID (LFID) to edit our wiki pages and chat on Hyperledger channels. Here's how to get your LFID

Step 2: Join the conversation by subscribing to the Hyperledger Capital Markets Special Interest Group mailing list which is where the Mortgage Subgroup activities take place. Click here to Join the mailing list.

Meeting Schedule Notes & Recordings

Important notice:

- All meetings are recorded using Zoom and made available in the Meeting Notes & Recoding section below on this page.

- All meetings are covered by the following Antitrust Policy.

- Hyperledger is committed to creating a safe and welcoming community for all. For more information please visit our Hyperledger Code of Conduct.

Next Meeting Date & Time

| Date | USA Pacific Time | USA Eastern Time | Europe Central Time | Japan Standard Time |

|---|---|---|---|---|

| January 11, 2024 | 9 AM | 12 PM | 6 PM | 2 AM |

| February 8, 2024 | 9 AM | 12 PM | 6 PM | 2 AM |

| March 14, 2024 | 9 AM | 12 PM | 6 PM | 2 AM |

| April 11, 2024 | 9 AM | 12 PM | 6 PM | 2 AM |

| May 8, 2024 | 9 AM | 12 PM | 6 PM | 2 AM |

| June 13, 2024 | 9 AM | 12 PM | 6 PM | 2 AM |

| July 11, 2024 | 9 AM | 12 PM | 6 PM | 2 AM |

| August 8, 2024 | 9 AM | 12 PM | 6 PM | 2 AM |

| September 12, 2024 | 9 AM | 12 PM | 6 PM | 2 AM |

| October 10, 2024 | 9 AM | 12 PM | 6 PM | 2 AM |

| November 14, 2024 | 9 AM | 12 PM | 6 PM | 2 AM |

Meeting Agenda

New Member Introductions: 5 minutes

- If you’re new to the group, please…

- Introduce yourself, your background, and your interest in the group

- Tell us where you're geographically located

- Your anticipated level of participation/commitment

(active, infrequent, capable of taking on a role and/or task) - What days, times you prefer or can work with

- Respond to queries and comments from the group

- Consider posting your contact information in our list, click here > FMSIG Mortgage Industry Subgroup Members

(Note: to post your contact information you need to create your Linux Foundation ID (LFID) to edit our wiki pages and chat on Hyperledger channels. Here's how to get your LFID)

Review of last meeting agenda: Goals, Next steps, Announcements: 10 minutes

- General review of mission statement and goals

- Progress or next steps review

- Feel free to make an announcement here on the call or on our email group

General discussion : 40 minutes

- Topics per scheduled meeting agenda

Wrap up: 5 minutes

- Next steps review

- Ideas for future agenda items

Meeting Notes & Recordings

Resources

New to Hyperledger? You'll need a Linux Foundation ID (LFID) to edit our wiki pages and chat on Hyperledger channels. Here's how to get your LFID

Mortgage Industry Subgroup: Join the mailing list.

Global Mortgage Industry Research

JPMorgan’s Onyx Aims to Industrialize Proof-of-Concept

by Blockchain Council

Image AddedMorgan Stanley Wealth Management Announces Latest Game-Changing Addition to Suite of GenAI Tools

Image AddedMorgan Stanley Wealth Management Announces Latest Game-Changing Addition to Suite of GenAI Tools

by Morgan Stanley

Image AddedSymbiotic Relationship Between Blockchain and AI

Image AddedSymbiotic Relationship Between Blockchain and AI

by Blockchain Council

Image AddedAI for Mortgage: ‘Do or Do Not. There is No Try’

Image AddedAI for Mortgage: ‘Do or Do Not. There is No Try’

by Mark Dangelo

Image AddedHow Blockchain is Transforming Real Estate? Unlocking New Possibilities

Image AddedHow Blockchain is Transforming Real Estate? Unlocking New Possibilities

By LinkedIn

Image AddedReal Estate Tokenization will Be Key to Solving Affordable Housing Challenges

Image AddedReal Estate Tokenization will Be Key to Solving Affordable Housing Challenges

by CoinCodex

Image AddedFractIt Revolutionizes Real Estate: Completes Pilot with Tokenization of Luxury Property on Blockchain

Image AddedFractIt Revolutionizes Real Estate: Completes Pilot with Tokenization of Luxury Property on Blockchain

by MarketWatch